The CBI’s recent moves against IDBI Bank and chairman of Syndicate Bank are likely signs of the government getting tough on bad loans in the banking system.

Bad loan menace: What’s in store for banks?

IIP, CPI disappoint: Economic revival delayed

Consumer price inflation accelerated in July and factory output grew at a slower pace in June, dampening hopes of an economic turnaround and increasing the pressure on policymakers struggling to contain prices and revive growth.

Just a Mint : Trade deficit & gold imports

India’s trade deficit surged to an 11-month high, the fastest pace since July 2013. CEO of Federation of Indian Export Organisation, Ajay Sahai, offers his perspective.

Kotak Mahindra to buy 15% stake in MCX

Kotak Mahindra Bank is set to pick up a 15% stake in Multi Commodity Exchange of India from Financial Technologies India Limited. The deal is valued at Rs. 459 crore and is subject to approval from market regulator SEBI. FTIL’s latest agreement to sell stake will reduce its shareholding in MCX to 5%.

IMF growth forecasts in : How does India stack up?

The International Monetary Fund is out with its latest growth forecasts. India is the only emerging economy among the BRICS to have avoided a forecast cut.

FDI cap hiked | What does it mean for Indian insurance?

The BJP-led NDA has gone ahead with its first major reform. It has given its nod for a proposal to hike the FDI limit in the insurance sector to 49% from the existing 26%.

NSEL crisis : A year on

It’s been a year since the Rs.5,574.35 crore NSEL scam unfolded. 13,000 investors are still waiting for justice. Nearly Rs.5,334.31 crore of investor money still remains stuck.

Digital video, the next big frontier

New Delhi: The big message from the just concluded third annual Digital Content NewFronts in New York is actually a warning for the unprepared and the uninitiated: digital video is going to be the next big frontier.

Following an upfront model, the Interactive Advertising Bureau (IAB) based in New York, lined up heavy hitters—with a few up-and-coming players—to answer the existential question of how to increase the flow of advertising investment.

First, the numbers. According to projections put out by GroupM, investment in digital media this year will account for little over a fifth of measured spending globally. And no surprise, digital video, in particular, remains the fastest growing format of the display market, exhibiting a 19% increase and trebling to $2.8 billion in 2013 from $908 million in 2009, report IAB and PricewaterhouseCooper’s Digital Advertising Revenue Report 2013.

The increase in the share of digital has come at the expense of print media, while television’s share of overall global ad spending has remained steady at around 45%. It can be argued that while the marketer’s spending on digital video is growing in double digits, compared with single digit gains for television, the ad pie is still dominated by television.

It is no rocket science that to exploit the potential of digital video, a sustainable business model that successfully monetizes content is a prerequisite. The digital aspirations of the six founding partners of the event, NewFronts 2014—AOL, DigitasLBi, Google/YouTube, Hulu, Microsoft, Yahoo and 14 other prominent companies that produce and distribute original digital video programming—was neatly laid out at the New York summit. Obviously marketers and media buyers seized on this rather unique opportunity to seek valuable partnerships with digital content creators—which can be broadly divided into four genres.

Buzzfeed, a digital native, believes in the power of social video. With close to a half of all videos being viewed on mobile devices and social networks assuming the role of distribution channels, the reach and impact of social video is dramatic. For BuzzFeed, building shareable video formats optimized for mobile is key to succeeding in the crowded marketplace of online content creators.

The New York Times took much pride in proclaiming that it is not a newspaper, instead, a hub of 430 videos a month. Yahoo, in the same spirit of projecting itself as a market differentiator, described itself as a collection of high-end content creators. If online video is setting a precedent for the Internet era, interactive television, the second genre, cannot be far behind. Predictably, Microsoft’s Xbox Entertainment Studios unveiled a new television experience to bring bold original shows to life through the Xbox. Its focus is on providing TV programming including scripted and unscripted series, animation, reality, documentaries and live events—across an array of screens.

With an established ecosystem for premium curated content, Glam Media, the seventh largest media property in the United States with over 15,000 content businesses, introduced Project M, which exemplifies the third genre. The idea is to align the content marketing efforts of the company with video. Similarly, Conde Nast Entertainment (CNE) is promoting the concept of creating digital first content for a new generation of its affluent digital audiences. In the last one year, CNE launched 11 digital video channels for some of the most powerful media brands – Vogue, Vanity Fair, GQ, Glamour, The New Yorker and Wired. Having generated more than 560 million video views last year, their presentation showcased new digital channels, new series and new video platforms.

This brings us to the fourth genre. Positioning ads as content, Susan Wojcicki, YouTube CEO, had excited advertisers. Google Preferred gives advertisers the opportunity to partner with the top talent on YouTube and with verified measurement by Comscore and Nielsen, she said. DigitasLBi would be the first agency partner for Google Preferred.

In support of Wojcicki’s view, PepsiCo Inc.’s chief marketing officer Frank Cooper said that while in the past it raved about past partnerships with music superstars, the trend is now shifting to working with YouTube stars like Devon Supertramp because of the sharing potential. “Sharing is brand nirvana,” said Cooper, praising the real-time analytics YouTube offers.

Digital immigrants Time Inc. and The Wall Street Journal are not too far behind with their digital video ambitions. Time Inc., in its presentation, expanded on its storytelling expertise across all platforms and its digital video initiatives providing ad partners with premium quality programming, access to talent and new ways to reach influential audiences at scale. The Wall Street Journal on the other hand, demonstrated its keen interest in building new custom solutions and redefining the way consumers interact with the content.

In conclusion, the conference laid out the milestones that media companies need to traverse if they are to serve the emerging digital video consumer on multiple screens. It is not a choice though for anyone who wants to be part of the rapidly transforming digital era. Those who hesitate will only have themselves to blame.

Read more at: http://www.livemint.com/Opinion/nsFIr47cS93Q4X2DAEmZxJ/Digital-video-the-next-big-frontier.html?utm_source=copy

CFPB to police employers over Payroll Cards

Natalie Gunshannon, 27 of Dallas Township, Pa., is a single mother of one daughter. In May 2013, she had just started working at the McDonald’s Restaurant on the Dallas Highway but decided to quit when she received her first pay stub. She didn’t just quit. Gunshannon reached out to an attorney, Mike Cefalo of West Pittston and filed a class action lawsuit in Luzerne County Court against her employer.

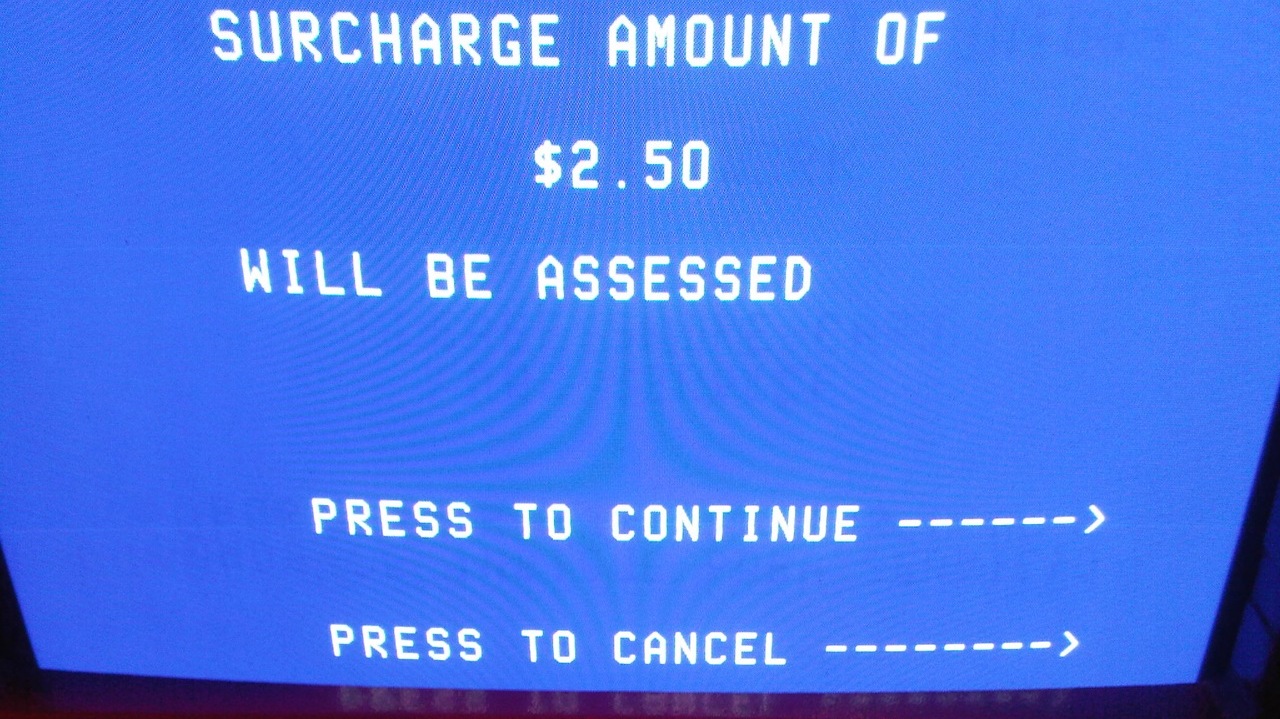

It is not common to walk into an attorney’s office instead of the supermarket upon receiving your hard-earned pay. Gunshannon explained that her first paycheck was enclosed in a Chase Bank debit card with instructions on how to use it and the fees attached. Among the several fees listed on the schedule were a $1.50 charge for ATM withdrawals, $5 for over-the-counter cash withdrawals, $1 per balance inquiry, 75 cents per online bill payment and $15 for a lost/stolen card.

The following day she reached out to her supervisor and asked if she could be paid by check or direct deposit. “No!” was the categorical answer. The card was the only way.

Gunshannon was to make $7.44 per hour, and the minimum wage is $7.25. Now, with the given charges, her hourly wage could even go below the minimum wage. “I need to receive all the money I earn,” she urged her employers. “I can’t afford to lose even a few dollars per paycheck. I just think people should be paid fairly and not have to pay fees to get their wages,” she begged.

The case created a furor around the use of the payroll card. The Consumer Financial Protection Bureau (CFPB) sought to address this and on Thursday warned employers against compelling employees to receive wages on payroll cards that have a slew of fees attached. In a published bulletin, the CFPB clarified the federal consumer protections that apply to payroll cards – fee disclosure, access to account history, limited liability for unauthorized use and error resolution rights.

Federal law prohibits employers from mandating that employees receive wages solely through a payroll card. State laws have the jurisdiction to see which alternative payment methods employers can offer.

“Employees must have options when it comes to how they receive their wages,” CFPB Director Richard Cordray asserted in a statement. “Today’s release warns employers that they cannot mandate their employees to receive wages on a payroll card. And for those employees who choose to receive wages on a payroll card, they are entitled to certain federal protections.”

Reports made to the CFPB in recent months over the issue of payroll cards are particularly related to retail and food service industries. Several companies are engaged in paying their workers through payroll cards to avoid the cost of issuing paper checks. Aite Group, a consulting firm specializing in the payments industry, states that the number of payroll cards is rising from 3.1m in 2010 to 5.8m today and is expected to rise to 10.8m in 2017. “Employers this year are expected to load $43b onto the cards, rising to $68.9b by 2017,” Aite revealed.

The cards mean big business for financial services companies, including banks and card networks – Visa and MasterCard. First Data Corp. is one of the biggest industry players and operates payroll card programs that are issued by banks.

Responding to the controversy around payroll cards, Mark Putman, Senior Vice President of First Data’s prepaid solutions, said, “Consumers need choice and this guideline is one of the pillars of our program. CFPB’s guidelines reiterate practices we have a history of following.”

In an emailed statement, the CFPB reasserted its regulation of employers over violations of payroll cards, stating, “The bureau intends to use its enforcement authority to stop violations before they grow into systemic problems, maximize remediation to consumers, and deter future violations.”

However there is another side to this coin. For employees who are unbanked, payroll cards can indeed be an inexpensive alternative. Unbanked employees may end up paying far more to cash a check at Walmartor at a check cashing point or may incur additional costs when they pay a bill online through a third party like Western Union.

If the unbanked employees open a bank account, for example a Bank of America account, they will incur a monthly charge of $10 -$14 and may risk being charged overdraft fees, not to mention paying $2.50 if they take cash from an ATM not operated by Bank of America. The costs involved in using payroll cards, as compared to the costs of using alternative means of pay, might be lesser and this method may end up being the more affordable option for many employees – but that may not always be the case.

“In general, payroll cards can be a useful way to pay employees who don’t have bank accounts, who can’t have direct deposit,” explained Lauren Saunders, Managing Attorney at the National Consumer Law Center. “For an employee who doesn’t have a bank account, a well-designed payroll card can be a fast, convenient and inexpensive way of getting your money but in practice, the cards can hit workers with a fusillade of fees that substantially cut into their wages, including monthly maintenance fees, point-of-sale fees, ATM fees and even overdraft fees,” she added.

In an attempt to bring clarity to the glaring question of whether payroll cards could work well for employees, the Consumer’s Union clarifies some of the aspects in a report. Card programs vary widely in terms of cost, convenience and level of consumer protection and it is important to make the right decision over the payroll card program employers choose.

The report recommends that employers choose a reliable payroll card vendor to avoid the risk of employees losing money if the payroll card issuer goes out of business and to ensure the contract with the issuer requires consumer protection and negotiate the possibility of no monthly fees. It urges employers to identify and restrict the fees such that the card becomes the first step towards financial stability for employees.

Above all, it recommends giving employees a choice. Employees must be offered a choice of receiving a paper check.

To draw an absolute judgment on whether payroll cards are a good means to earn pay or not would be unfair, since it depends on whether the consumer is banked or unbanked and if the alternatives open to a respective consumer would cost any less.

Next Steps in the Durbin Litigation

On 31st July, 2013 the District of Columbia trial court invalidated the Federal Reserve Board’s Durbin regulation, suspending the swipe fee regulation in a cloud of open-ended questions. In an exclusive interview with PYMNTS.com, Ronald Mann, Albert E. Cinelli Enterprise Prof. of Law, Co-Dir. Charles E. Gerber Program in Transactional Studies at Columbia Law School, elaborates on the next steps in the NACS regulation.

KMK: Ron, this invalidation has left the payments community with a number of open-ended questions. How do you see the future proceedings shaping up?

RM: The district court vacated the existing regulation, but stayed its order, so the current status is that the Board’s regulation remains in force for the time being, despite the court’s conclusion that it is invalid. Essentially, that leaves the Board obligated to produce a new regulation on a schedule with sufficient promptness to satisfy the Court. Whether the new regulation will be preceded by notice and comment will be a decision for the Board, though given the complexity of the issues and the stark changes from the Board’s existing interpretation a renewed comment period seems likely.

KMK: There is a lot of speculation around how the Board is likely to react if the course of action the court suggests is unacceptable to the Board. What do you think is likely to happen on appeal?

RM: So assuming that course of action is unpalatable to the Board, the Board’s appeal would go to the United States Court of Appeals for the District of Columbia Circuit, which sits in Washington in the same building as the District Court. The timing of that appeal is difficult to predict, though it seems most unlikely it would be completed in less than a year. And even then, if the Board lost it well might seek review in the Supreme Court. Even with the shrinking docket, there is always a reasonable chance the Court would review a decision invalidating a regulation of this significance.

KMK: What will be the key question on this appeal, if the Board presses ahead for one?

RM: It will be to balance statutory text against deference to agency expertise. It is hard to challenge the view that the statute is poorly drafted, and that the Board was hard-pressed to design a regulation that was both practical and consistent with the statute. The district court’s broad conclusion that the regulation was inconsistent with the statute surely reflects the fact that the litigation here was between the retailers and the Board, with the banks not directly present to explain their side of the matter. It is always difficult to predict how the court of appeals will receive this kind of case, but my sense is that it is quite a difficult one, so that the result on appeal is most uncertain.