Natalie Gunshannon, 27 of Dallas Township, Pa., is a single mother of one daughter. In May 2013, she had just started working at the McDonald’s Restaurant on the Dallas Highway but decided to quit when she received her first pay stub. She didn’t just quit. Gunshannon reached out to an attorney, Mike Cefalo of West Pittston and filed a class action lawsuit in Luzerne County Court against her employer.

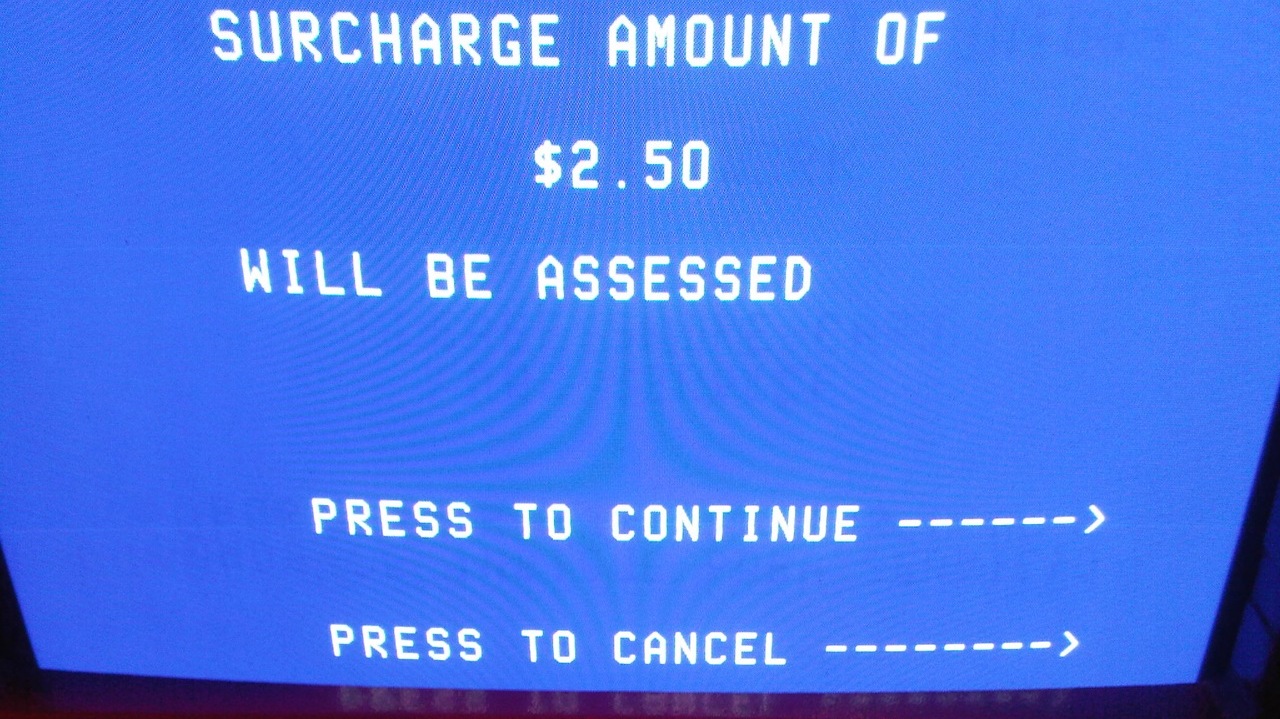

It is not common to walk into an attorney’s office instead of the supermarket upon receiving your hard-earned pay. Gunshannon explained that her first paycheck was enclosed in a Chase Bank debit card with instructions on how to use it and the fees attached. Among the several fees listed on the schedule were a $1.50 charge for ATM withdrawals, $5 for over-the-counter cash withdrawals, $1 per balance inquiry, 75 cents per online bill payment and $15 for a lost/stolen card.

The following day she reached out to her supervisor and asked if she could be paid by check or direct deposit. “No!” was the categorical answer. The card was the only way.

Gunshannon was to make $7.44 per hour, and the minimum wage is $7.25. Now, with the given charges, her hourly wage could even go below the minimum wage. “I need to receive all the money I earn,” she urged her employers. “I can’t afford to lose even a few dollars per paycheck. I just think people should be paid fairly and not have to pay fees to get their wages,” she begged.

The case created a furor around the use of the payroll card. The Consumer Financial Protection Bureau (CFPB) sought to address this and on Thursday warned employers against compelling employees to receive wages on payroll cards that have a slew of fees attached. In a published bulletin, the CFPB clarified the federal consumer protections that apply to payroll cards – fee disclosure, access to account history, limited liability for unauthorized use and error resolution rights.

Federal law prohibits employers from mandating that employees receive wages solely through a payroll card. State laws have the jurisdiction to see which alternative payment methods employers can offer.

“Employees must have options when it comes to how they receive their wages,” CFPB Director Richard Cordray asserted in a statement. “Today’s release warns employers that they cannot mandate their employees to receive wages on a payroll card. And for those employees who choose to receive wages on a payroll card, they are entitled to certain federal protections.”

Reports made to the CFPB in recent months over the issue of payroll cards are particularly related to retail and food service industries. Several companies are engaged in paying their workers through payroll cards to avoid the cost of issuing paper checks. Aite Group, a consulting firm specializing in the payments industry, states that the number of payroll cards is rising from 3.1m in 2010 to 5.8m today and is expected to rise to 10.8m in 2017. “Employers this year are expected to load $43b onto the cards, rising to $68.9b by 2017,” Aite revealed.

The cards mean big business for financial services companies, including banks and card networks – Visa and MasterCard. First Data Corp. is one of the biggest industry players and operates payroll card programs that are issued by banks.

Responding to the controversy around payroll cards, Mark Putman, Senior Vice President of First Data’s prepaid solutions, said, “Consumers need choice and this guideline is one of the pillars of our program. CFPB’s guidelines reiterate practices we have a history of following.”

In an emailed statement, the CFPB reasserted its regulation of employers over violations of payroll cards, stating, “The bureau intends to use its enforcement authority to stop violations before they grow into systemic problems, maximize remediation to consumers, and deter future violations.”

However there is another side to this coin. For employees who are unbanked, payroll cards can indeed be an inexpensive alternative. Unbanked employees may end up paying far more to cash a check at Walmartor at a check cashing point or may incur additional costs when they pay a bill online through a third party like Western Union.

If the unbanked employees open a bank account, for example a Bank of America account, they will incur a monthly charge of $10 -$14 and may risk being charged overdraft fees, not to mention paying $2.50 if they take cash from an ATM not operated by Bank of America. The costs involved in using payroll cards, as compared to the costs of using alternative means of pay, might be lesser and this method may end up being the more affordable option for many employees – but that may not always be the case.

“In general, payroll cards can be a useful way to pay employees who don’t have bank accounts, who can’t have direct deposit,” explained Lauren Saunders, Managing Attorney at the National Consumer Law Center. “For an employee who doesn’t have a bank account, a well-designed payroll card can be a fast, convenient and inexpensive way of getting your money but in practice, the cards can hit workers with a fusillade of fees that substantially cut into their wages, including monthly maintenance fees, point-of-sale fees, ATM fees and even overdraft fees,” she added.

In an attempt to bring clarity to the glaring question of whether payroll cards could work well for employees, the Consumer’s Union clarifies some of the aspects in a report. Card programs vary widely in terms of cost, convenience and level of consumer protection and it is important to make the right decision over the payroll card program employers choose.

The report recommends that employers choose a reliable payroll card vendor to avoid the risk of employees losing money if the payroll card issuer goes out of business and to ensure the contract with the issuer requires consumer protection and negotiate the possibility of no monthly fees. It urges employers to identify and restrict the fees such that the card becomes the first step towards financial stability for employees.

Above all, it recommends giving employees a choice. Employees must be offered a choice of receiving a paper check.

To draw an absolute judgment on whether payroll cards are a good means to earn pay or not would be unfair, since it depends on whether the consumer is banked or unbanked and if the alternatives open to a respective consumer would cost any less.