“We urge the Federal Reserve to pursue all legal means to mitigate the harm this decision will cause to consumers, community banks and all institutions that provide financial services to local communities. The Durbin Amendment and the court’s interpretation will have disastrous consequences for the institutions affected and the communities they serve. This result must be reversed”, Frank Keating, President of the American Bankers Association, said in response to U.S. District Judge Richard Leon’s rejection of the Durbin Amendment, yesterday morning.

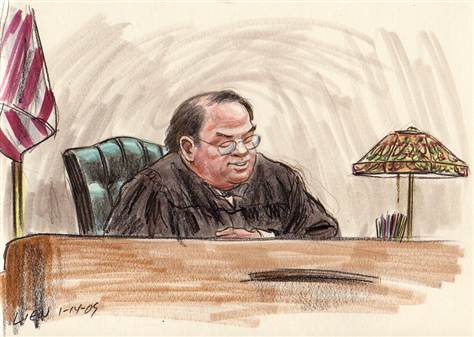

Ridiculing the Fed, Judge Leon pointed out brusquely, “The Fed didn’t have the authority to set a 21-cent cap on debit-card transactions. The Board has clearly disregarded Congress’s statutory intent by inappropriately inflating all debit card transaction fees by billions of dollars and failing to provide merchants with multiple unaffiliated networks for each debit card transaction”.

Ridiculing the Fed, Judge Leon pointed out brusquely, “The Fed didn’t have the authority to set a 21-cent cap on debit-card transactions. The Board has clearly disregarded Congress’s statutory intent by inappropriately inflating all debit card transaction fees by billions of dollars and failing to provide merchants with multiple unaffiliated networks for each debit card transaction”.

In his 58-page ruling Judge Leon argued that the cap must go lower, cutting deeper into the $16 billion dollars in revenue that large banks usually reap from the fees. “The Fed’s current implementation of the Durbin amendment has cost banks about half the $16 billion they once made from debit-card swipe fees each year. They take in an estimated $40 billion from credit card swipe fees, which are unaffected by the Fed rule”, Madeline Aufseeser, Senior Analyst, Aite Group LLC, calculated. She added, “If the Fed responds to the ruling by reverting to its original proposal of 12 cents per transaction, revenue for the top 50 credit-card issuers who use Visa and MasterCard networks and have assets over $10 billion would drop to $4.3 billion per year.”

Visa, the dominant player setting the interchange fees, saw its share price plunge the most since December 2010, falling as low as 10.7 percent in New York trading and closing down 7.5% at $177,01. The same shares shot up more than 10 percent, topping the S&P 500, after the final cap was unveiled in 2011 and surprised the business by being almost twice as high as the Fed’s earlier draft proposal.

Judge Leon warned, ‘The Fed has months not years to re write the rule in the light of this decision’.

A central argument that encompasses this debate is that swipe fees, under the Durbin Amendment, must be “reasonable and proportional” to the incremental cost of a transaction. The Dodd-Frank legislation which adopted the Durbin Amendment does not clarify whether the caps should reflect ‘other costs’ incurred by card issuers. The banks hence press for the caps to rise to reflect other costs.

Judge Leon argued that the Fed wrongly interpreted the statue on these costs. “The Fed decided the statute was silent on what other costs could be included in the calculation, and then moved to resolve that ambiguity by including those other costs. How convenient,” Leon remarked. “The statute and the legislative history demonstrate that Congress intended the swipe fee caps to reflect only the costs associated with an individual transaction, not any other costs”, he remarked.

He further added in a statement, “The Fed’s 2011 decision to bend to the lobbying by the big banks and card giants cost small business and consumers tens of billions of dollars and did not do enough to rein in the anti-competitive, anti-consumer practices of Visa and MasterCard”.

In November 2011, National Retail Federation, the Food Marketing Institute and NACS, formerly the National Association of Convenience Stores filed a lawsuit stating the merchants would be substantially harmed by the fees the Fed set under the Durbin Amendment. “The board’s final rule permits banks to recover significantly more costs than permitted by the plain language of the Durbin Amendment and deprives plaintiffs of the benefits of the statute’s anti-exclusivity provisions,” the retailers argued in their complaint.

Refuting the retailers claim, Senator Durbin insisted that small businesses and their customers will be able to keep more of their own money as a result of the amendment and it would make sure businesses would grow and prosper. ‘This is vital to putting our country back on solid economic footing’, he said in a statement.

Citing a recent push by European Union to cap the charges, Mallory Duncan, Senior Vice President and General Counsel of the National Retail Federation, which brought the case, pointed out that opposition to swipe fees is growing world-wide, “The rest of the world is beginning to understand that this is a game Visa, MasterCard and the banks are playing,” she said in an interview.

The law may have been squarely aimed at big banks, but small banks have paid a price in the bargain.

Chairman Ben Bernanke had said on several occasions that he was worried about how the new rule would affect small banks. He maintained the cap aimed to strike a balance between retailers, banks and consumers but left the door open for future changes. “The Fed would continue to monitor the consequences of the new caps and “assess whether the statute and the rule are accomplishing their intended goals”, Bernanke noted in a statement after the Amendment was passed.

Chairman Ben Bernanke had said on several occasions that he was worried about how the new rule would affect small banks. He maintained the cap aimed to strike a balance between retailers, banks and consumers but left the door open for future changes. “The Fed would continue to monitor the consequences of the new caps and “assess whether the statute and the rule are accomplishing their intended goals”, Bernanke noted in a statement after the Amendment was passed.

Leon’s ruling echoes the voices of the retailers that have been fighting against the law since November 2011.